Course Library

We're sorry, but we couldn't find any results that match your search criteria. Please try again with different keywords or filters.

Loading

-

Field of Study:

- Regulatory Ethics

Credit Hours:

- 1 - 4 credits

Description:

This course covers information included in Treasury Department Circular No. 230 and offers ethics education for Enrolled Agents, CPAs and unenrolled tax preparers. This course covers ethics rules and ...Program Level:

IntermediateDelivery Method:

- QAS™ Self Study

-

Field of Study:

- Regulatory Ethics

Credit Hours:

- 1 - 4 credits

Description:

This course covers information included in Treasury Department Circular No. 230 and offers ethics education for Enrolled Agents, CPAs and unenrolled tax preparers. This course covers ethics rules and ...Program Level:

IntermediateDelivery Method:

- QAS™ Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

The IRS will most likely require you to file an information return, if you have made a payment during the calendar year as a self-employed individual or while operating as a small business. As your in ...Program Level:

IntermediateDelivery Method:

- Group Internet Based

-

IRS Form 1099 in 2024: W-9, Backup Withholding and the New De Minimis Error Rules

22-Jan-2024 ClatidField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

IRS Form 1099 Due Diligence in 2024 Join us to learn the latest updates for Form 1099-MISC, specific reporting requirements for various types of payments and payees, filing requirements, withholding r ...Program Level:

BasicDelivery Method:

- Group Internet Based

-

IRS Form 1099 Reporting Requirements & Withholding - IRS Forms 1099-NEC and 1099-MISC Updates

13-Jan-2023 ClatidField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

As more and more small businesses are using independent contractors, the need to file 1099s is increasing. The IRS brought back Form 1099-NEC for 2021. This webinar will help participants know when th ...Program Level:

IntermediateDelivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

As the digital asset landscape continues to evolve, tax and accounting professionals face new challenges in ensuring compliance with IRS regulations. The introduction of Form 1099-DA marks a significa ...Delivery Method:

- QAS™ Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

As the digital asset landscape continues to evolve, tax and accounting professionals face new challenges in ensuring compliance with IRS regulations. The introduction of Form 1099-DA marks a significa ...Delivery Method:

- Group Internet Based

-

Field of Study:

- Accounting

Credit Hours:

- 1 - 4 credits

Description:

Form 1099-K is used to report certain payment transactions including payments by payment cards (credit, debit, or stored value cards) and payments in settlement of third-party network transactions or ...Program Level:

INTERMEDIATEDelivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Form 1099 reporting has always been tricky, and changes in 2020 and 2021 continue to increase the reporting burden. Tucked away in the American Rescue Plan was a change to reporting on a form called a ...Program Level:

IntermediateDelivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Are you up-to-date with the latest shifts in unemployment taxes? Join us for an enlightening webinar titled "IRS Form 940 and Unemployment," aimed at unraveling the intricate modifications in federal ...Delivery Method:

- QAS™ Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Did you know that thousands of POA forms, including Forms 8821 and 2848, are rejected every year due to common mistakes? These errors can slow down critical processes for your clients and cost valuabl ...Delivery Method:

- Group Internet Based

-

IRS Forms W-8BEN and W-9 Compliance After Tax Reform: New Information Requirements and ECI Rules

24-Jul-2019 Barbri, Inc.Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Delivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- less than 1

Description:

Are you prepared for the increasing cybersecurity threats targeting taxpayers and practitioners during the holiday season? As online shopping surges, so does the risk of scams designed to steal person ...Delivery Method:

- Nano Learning

-

IRS Installment Agreements - How to Effectively Set Up A Payment Arrangement with the IRS

24-Feb-2023 ClatidField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Tax debt is nothing to brush off, especially when you owe an outrageous amount. If you can’t afford your tax debt, the IRS must decide if – and how – you’ll be able to pay. There are many different ty ...Program Level:

BasicDelivery Method:

- Group Internet Based

-

Field of Study:

- Information Technology

Credit Hours:

- 1 - 4 credits

Description:

Are you ready to unlock the full potential of the IRS online services? Join our CPE webinar and explore the hidden gems of the IRS digital world. In this course, you'll discover dozens of valuable IRS ...Delivery Method:

- QAS™ Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

IRS issues the “B” and “C” Notices in the fall of the year. Learn the reasons behind the notices and how you can assist your client in navigating how to prevent the notice and problems associated with ...Delivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- less than 1

Description:

For the first time in years, the IRS has issued lower auto depreciation limits, which will significantly affect businesses that rely on vehicle deductions. This CE nano-learning course by Eric Knight ...Delivery Method:

- Nano Learning

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Employee Retention Credit (ERC) Claims In mid-September, the IRS announced a moratorium on processing new employee retention credit (ERC) claims through at least December 31, 2023. Tax professionals a ...Program Level:

BasicDelivery Method:

- Group Internet Based

-

IRS Notice 2022-6 Sharply Hikes Distributions From Qualified Plans Pre-59½, Robert Keebler's February Webinar

17-Feb-2022 Advisors4AdvisorsField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

One of the most important financial planning stories of 2022: New rules in IRS Notice 2022-6 just sharply hiked distributions amounts permitted from qualified plans before age 59½. The new rules wil ...Program Level:

OverviewDelivery Method:

- Group Internet Based

Location:

- NY

-

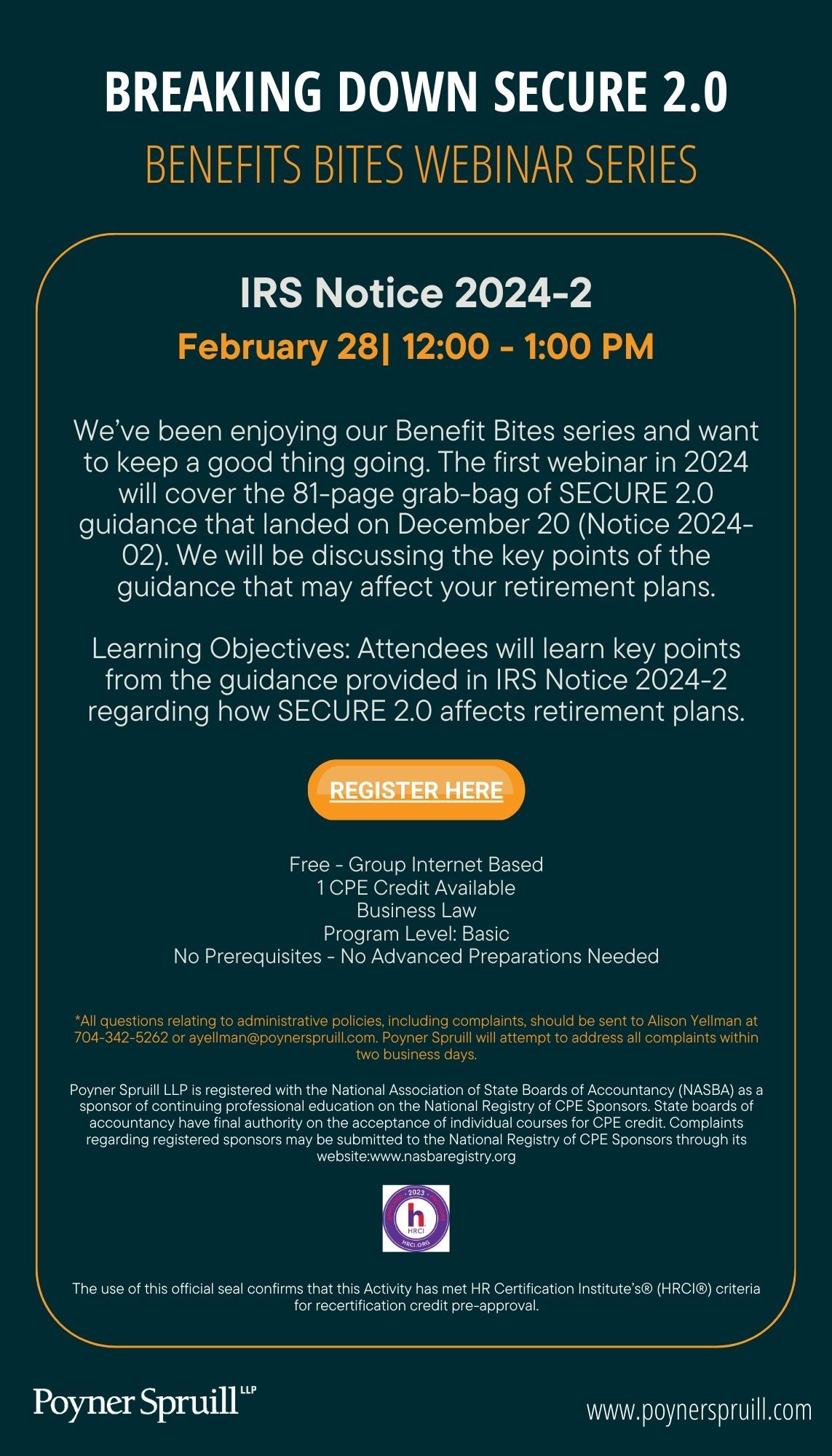

Field of Study:

- Business Law

Credit Hours:

- 1 - 4 credits

Description:

We’ve been enjoying our Benefit Bites series and want to keep a good thing going. The first webinar in 2024 will cover the 81-page grab-bag of SECURE 2.0 guidance that landed on December 20 (Notice 20 ...Program Level:

BasicDelivery Method:

- Group Internet Based

Location:

- NC

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Part 3 of a comprehensive 3-part series intended to help you understand and become savvy with the IRS Offer in Compromise program. This course goes in depth with a case study that shows five different ...Delivery Method:

- Group Internet Based

- QAS™ Self Study

Location:

- UT

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Part 1 of a comprehensive 3-part series intended to help you understand and become savvy with the IRS Offer in Compromise program. This course provides a rapid fire overview of the Offer In Compromise ...Delivery Method:

- Group Internet Based

- QAS™ Self Study

Location:

- UT

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Part 2 of a comprehensive 3-part series intended to help you understand and become savvy with the IRS Offer in Compromise program. This course goes in depth with more considerations when weighing the ...Delivery Method:

- Group Internet Based

- QAS™ Self Study

Location:

- UT

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

An offer in compromise is an agreement between a taxpayer and the IRS that settles the tax debt owed for a set price. There are two types of offer I'm compromises that will be covered in this presenta ...Program Level:

BasicDelivery Method:

- Group Internet Based

-

IRS Offshore Voluntary Disclosures: What’s Next In Disclosing Offshore Accounts LIVE Webcast

10-Jun-2016 The Knowledge Group, LLCField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

This Program will outline and cover: The IRS Voluntary Disclosure Programs of the past The current IRS Voluntary Disclosure Programs The changes that have recently taken place in the current IRS Volun ...Program Level:

IntermediateDelivery Method:

- Group Internet Based

Location:

- NJ

-

IRS on Earned Income Credit and Child Tax Credit: Claiming the Dependents in 2023

10-Mar-2023 ClatidField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Join us this March to learn about a foundational aspect of individual tax returns - claiming dependents. Tax law lays out two types of dependents – qualifying children and qualifying relatives. The ru ...Program Level:

BasicDelivery Method:

- Group Internet Based

-

IRS Payroll Audits for 2025: Surviving Those of Agencies and Conducting Your Own

09-May-2025 MY-CPE LLCField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Employers have more chances to be audited than ever before. Although most of us think of the IRS when the word "audit" is mentioned, they are not the only ones who audit. Wage and hour audits on the f ...Delivery Method:

- QAS™ Self Study

-

IRS Payroll Audits for 2025: Surviving Those of Agencies and Conducting Your Own

01-Jul-2025 MY-CPE LLCField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Employers have more chances to be audited than ever before. Although most of us think of the IRS when the word "audit" is mentioned, they are not the only ones who audit. Wage and hour audits on the f ...Delivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

This course is Part 2 of a comprehensive 2-part series intended to help you understand and become savvy with the IRS Penalty Abatement program. The IRS assesses millions of dollars of penalties agains ...Program Level:

AdvancedDelivery Method:

- Group Internet Based

- QAS™ Self Study

Location:

- UT

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

This course is Part 2 of a comprehensive 2-part series intended to help you understand and become savvy with the IRS Penalty Abatement program. The IRS assesses millions of dollars of penalties agains ...Delivery Method:

- Group Internet Based

- QAS™ Self Study

Location:

- UT

-

IRS Penalty Abatement Basics - Common Penalties, FTA Instructions, and Reasonable Cause Considerations

09-Nov-2017 Canopy TaxField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

This course is Part 1 of a comprehensive 2-part series intended to help you understand and become savvy with the IRS Penalty Abatement program. The IRS assesses millions of dollars of penalties agains ...Delivery Method:

- Group Internet Based

- QAS™ Self Study

Location:

- UT

-

IRS Penalty Abatement Basics - Common Penalties, FTA Instructions, and Reasonable Cause Considerations

Canopy TaxField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

This course is Part 1 of a comprehensive 2-part series intended to help you understand and become savvy with the IRS Penalty Abatement program. The IRS assesses millions of dollars of penalties agains ...Program Level:

BasicDelivery Method:

- Group Internet Based

- QAS™ Self Study

Location:

- CO

-

IRS Penalty Abatement or Forgiveness - Reducing or Removing IRS Interest from Your Tax Bill

26-May-2023 ClatidField of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

The Internal Revenue Service (IRS) Penalty Abatement program provides relief for taxpayers who have been penalized for failing to file their tax returns, failing to pay their taxes on time, or making ...Program Level:

BasicDelivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

As the digital asset landscape continues evolving, the IRS will likely refine its perspectives and guidelines further. With advancements such as decentralized finance (DeFi) and the emergence of new t ...Delivery Method:

- QAS™ Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

As the digital asset landscape continues evolving, the IRS will likely refine its perspectives and guidelines further. With advancements such as decentralized finance (DeFi) and the emergence of new t ...Delivery Method:

- Group Internet Based

-

Field of Study:

- Regulatory Ethics

Credit Hours:

- 1 - 4 credits

Description:

What does it take to practice before the IRS while staying compliant with its strict regulations? Tax professionals must follow ethical guidelines, meet rigorous requirements, and avoid sanctionable a ...Delivery Method:

- QAS™ Self Study

-

Field of Study:

- Regulatory Ethics

Credit Hours:

- 1 - 4 credits

Description:

Delivery Method:

- QAS™ Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

This course covers client refunds, due diligence in preparing returns penalties and compliance with e-File procedures.Delivery Method:

- QAS™ Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Form 941 is an essential form for all employers that pay employees and withhold federal and FICA (social security and Medicare) taxation. In recent years several changes to the 941 form have made it d ...Program Level:

IntermediateDelivery Method:

- Group Internet Based

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Form 941 is an essential form for all employers that pay employees and withhold federal and FICA (social security and Medicare) taxation. In recent years several changes to the 941 form have made it d ...Program Level:

IntermediateDelivery Method:

- Group Internet Based

-

Field of Study:

- Accounting

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

The IRS Form 941 is essential for all employers that pay employees and withhold federal and FICA (Social Security and Medicare) taxation. In recent years several changes to the 941 forms have made it ...Program Level:

IntermediateDelivery Method:

- Group Internet Based

-

Field of Study:

- Regulatory Ethics

Credit Hours:

- 1 - 4 credits

Description:

Learn everything you need to know about managing conflicts of interest between spouses, business partners, and tax professionals. This course covers power of attorney, IRS interactions, client privacy ...Program Level:

BeginnerDelivery Method:

- QAS™ Self Study

-

Field of Study:

- Regulatory Ethics

Credit Hours:

- 1 - 4 credits

Description:

It's essential that Circular 230 practitioners recognize and avoid conflicts of interest, as well as when to step away from clients who experience them. Course participants learn more about conflict o ...Program Level:

IntermediateDelivery Method:

- QAS™ Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

An Offer-in-Compromise (OIC) allows taxpayers to reach an agreement with the IRS to pay less than the total owed. You'll receive a detailed 6- step guide to requesting an OIC to achieve a reasonable s ...Program Level:

AdvancedDelivery Method:

- QAS™ Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Are you familiar with the guidelines the IRS uses to compute penalties and interest? Course participants gain valuable computation tools, as well as strategies for penalty and interest reduction. This ...Program Level:

IntermediateDelivery Method:

- QAS™ Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Learn how to resolve collection issues with an overview of the qualifications for and benefits of each type of resolution, as well as a detailed guide to which resolutions offer the best outcome for e ...Program Level:

BeginnerDelivery Method:

- QAS™ Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

Course participants learn more about the 433 Series Collection Information forms and the national standards that govern them. The course also addresses client expense planning to ensure the best deal ...Program Level:

BeginnerDelivery Method:

- QAS™ Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

With a step-by-step guide through the levy process, course participants learn more about why taxpayers are levied, how to avoid levies, and how levies are released. This course will cover the followin ...Program Level:

BeginnerDelivery Method:

- QAS™ Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

During this course, you'll learn about taking over an audit, constructing records for clients who failed to utilize proper accounting methods, preparing records and power of attorney, as well as commu ...Program Level:

IntermediateDelivery Method:

- QAS™ Self Study

-

Field of Study:

- Taxes

Credit Hours:

- 1 - 4 credits

Description:

The audit process doesn't end with successful collections or OIC. During this course, you'll learn more about the complexities of closing letters, lien release, adjustment of tax attributes, and amend ...Program Level:

IntermediateDelivery Method:

- QAS™ Self Study

26105 Results